What's App with $19B Acquisitions These Days?

In case you haven’t heard, Facebook just announced it will acquire mobile messaging company WhatsApp for $19 billion. And just like that, we have the largest venture backed acquisition in history (Sequioa alone pockets ~$3B), and the largest tech acquisition since HP/Compaq.

The news already has a few haters. Facebook stock is down about 5 percent at the time of this writing, due presumably to unease in a clear monetization plan, and some stock dilution from the equity portion of the deal. You can also expect to hear the word “bubble” many times this week.

There’s of course a lot to it, and I’ll leave the valuation angle to colleagues that wear that hat. From a tech and media perspective, it’s clear that messaging is now table stakes for companies building mobile products. Apple has iMessage, Google has Hangouts, and so on.

Facebook already has Messenger but it’s been pretty benign. So accelerating its moves into messaging can only happen through acquisition. There are also natural synergies between mobile messaging and a company that owns social connections, identity and a built-in network effect.

WhatsApp meanwhile was getting too big to ignore. Its messaging volume approaches the entire global telecom SMS market with 19 billion messages sent per day and 34 billion received (imbalance is due to group messaging). It also sends 900 million photos, voice & videos per day.

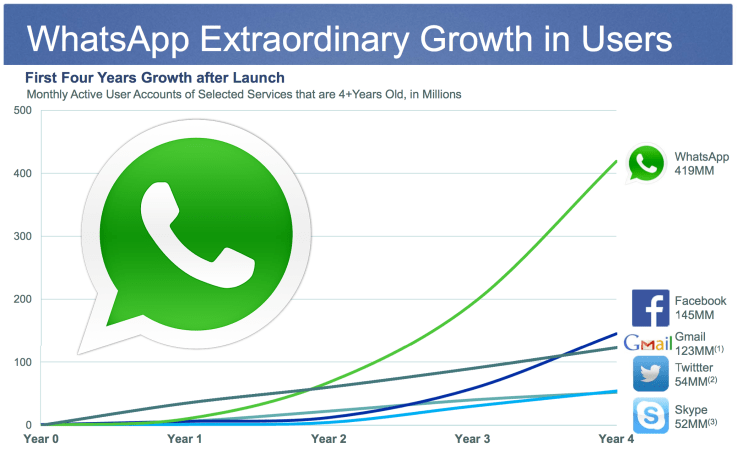

So it was a competitive threat if not bought, and a potential asset if bought (sound familiar?). Facebook has 550 million mobile active users, and WhatsApp already has 450 million. More importantly, those are mostly non-overlapping overseas users where Facebook’s growth plans lie.

As for the monetization question, there are a few ways to think about that. Mark Zuckerberg stated on the analyst call that they won’t monetize the app through ad support (it currently charges subscription in some countries). And they won’t integrate it with Facebook proper anytime soon.

But in the absence of ads or direct monetization, WhatsApp could be an effective loss leader to grow Facebook’s global user base. User acquisition is vital for a company like Facebook for which there’s a lock-in effect and a high lifetime customer value.

Monetization can then come in all of the other ways Facebook is building its revenue model. In that light WhatsApp can be seen as a play at sheer scale. And that needs to happen globally, where Facebook’s user base will underpin its network effect and all future plans as a business.

So was it worth $12B in cash and $7B in equity and earn outs? Probably not. But it’s not necessarily about how much WhatsApp is worth, but what’s it worth to Facebook? This comes back to Mark Zuckerberg’s apparent vision of buttressing Facebook’s growth with a messaging platform.

Tech valuations these days are less about traditional metrics like revenue multiples and ARPU. We’re seeing more weight put on another longstanding valuation metric: projected future cash flows. The challenge there is that it’s mired in intangibles for lots of tech companies.

In other words, Mark Zuckerberg’s projection is different than yours. And this discussion isn’t complete without SnapChat. Zuckerberg is clearly intent on owning messaging — including ephemeral messaging — if you consider the anemic launch of Poke and a failed $3B Snapchat acquisition.

WhatsApp now puts Facebook in the position to do what it failed to do in these earlier attempts. It can integrate ephemeral messaging at a scale well beyond SnapChat’s reach. This is clearly a vital part (at seemingly any cost) of Zuckerberg’s vision to maintain dominance of the social graph.

More soon from colleagues on the valuation side. In the meantime just for fun, here’s a list of things that are equal in value to WhatsApp’s price tag, as assembled by TechCrunch. I’ll add to their list, 19 billion packs of baseball cards and 62 million leprechauns.

$19 billion is…

— 4x the market cap of BlackBerry

— Approximately one-third the market cap of Ford

— 2.8x the market cap of GroupOn

— Effectively equal to the market cap of The Gap

— Slightly more than Sony’s market cap (around 10 percent)

— Around three-fourths the market cap of Delta

— 7.5 Mark Cubans

— Almost precisely one-third of HP’s market cap

— 2 nuclear submarines

— 62 percent of Twitter’s market cap

— 76,000 trips to space on Virgin Galactic

— Almost 60 percent of Sprint’s market cap

— 25 Instagram acquisitions