Location Targeted Mobile Revs to Reach $10.8B by 2017

Today, BIA/Kelsey released its U.S. Local Media Forecast (2012-2017), showing local ad revenues of $133B (2012) growing to $152B (2017). This includes advertising targeted to geographically specific audiences, such as Newspapers, Radio, TV, Interactive, etc..

One important slice of this forecast is the location targeted ad revenues attributed to mobile. That’s of course a small but quickly growing segment. In addition to these location targeted mobile revs, we panned back to look at the overall U.S. mobile ad revenue picture.

Interestingly, location targeted mobile ad revenues will grow to 54 percent of overall mobile revenues by 2017. This is driven by many market forces we examine in great detail and from discussions with industry players. We also break down revenue by format such as search and display.

The forecasting process is a doozy but we get bulletproof results and valuable findings. We’re looking to continue our streak of accurate numbers — affirmed in retrospect — for the past 5 years of looking closely at the mobile ad opportunity, not to mention decades covering local media.

The mobile exec summary is below, and BIA/Kelsey clients can log in to download the full report. Anyone else interested in finding out more can email me at mbolandATbiakelsey.com. We’ll also discuss these findings in greater depth next month at our Leading in Local conference.

Executive Summary

— Location targeted mobile advertising — the centerpiece of this forecast — is inclusive of total U.S. mobile advertising (see slide 19 for this breakdown).

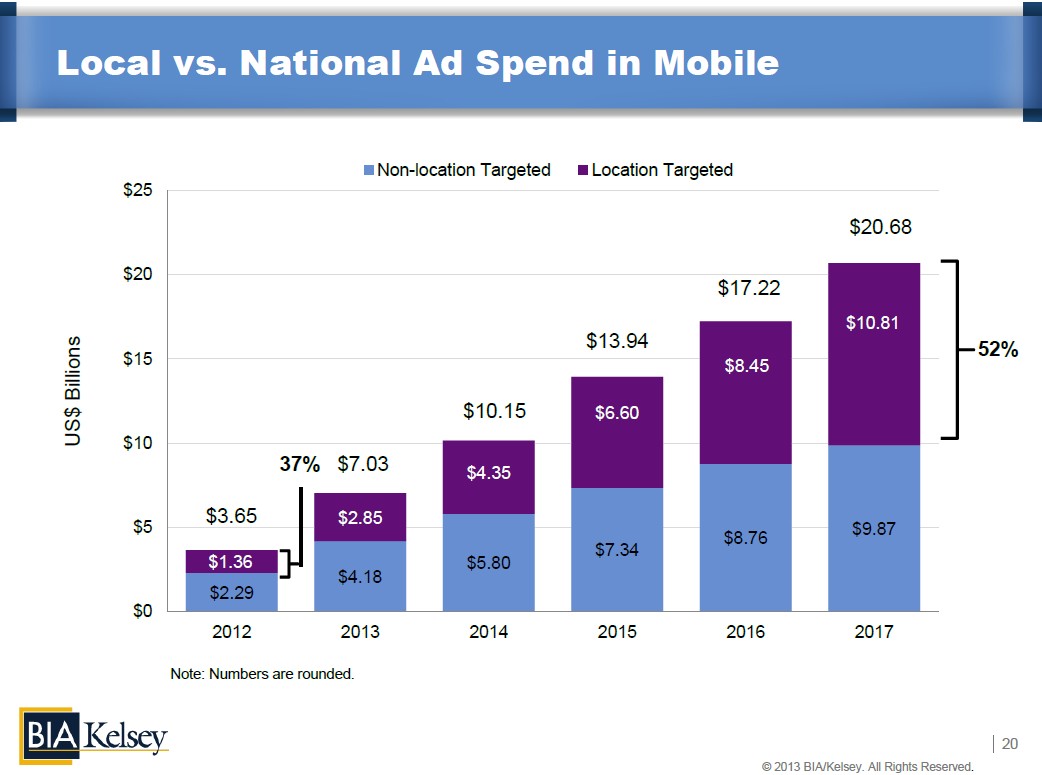

— To understand the localized portion requires first panning back to the total mobile ad revenue picture. Here, BIA/Kelsey projects revenue to grow from $3.65B in 2012 to $20.68B in 2017. This projection has increased from our previous forecast (March 2013).

— Increased projections result from guidance from mobile ad networks and ad share leaders such as Google (33% of paid clicks now come from mobile devices); and Facebook (49% of ad revenues attributed to mobile, up from 23% in March).

— Google’s Enhanced Campaigns*, launched in July, will compound these factors by forcing mobile ads on search advertisers (default campaign inclusion). This will accelerate a mobile advertising learning curve and adoption cycle for all search advertisers, including SMBs.

— Enhanced Campaigns will also notably close the current gap between mobile ad rates and desktop equivalents (rates are demand-driven).

— This will play out as an influx of advertisers in Google’s bid marketplace for mobile keywords will naturally boost bid pressure and thus CPCs. There is shift is already underway, evidenced by data shared with us by search marketing agencies.

— The share of the overall mobile ad revenue pie attributed to location based campaigns will grow from 37% ($1.4B) in 2012 to 52% ($10.8B) in 2017.

— This share shift remained fairly consistent from our previous forecast, as the factors driving

localized mobile ad adoption have remained steady.— These factors include advertiser demand, higher ad performance from location targeted ad campaigns, and resulting increases in mobile ad rates (CPMs, CPCs).

— Other important factors driving this localized share include the adoption of mobile local advertising tactics (i.e. geo-fencing, click-to-call, click to map) by national advertisers, who account for most U.S. mobile ad spending.

— SMB adoption — a slow but growing share of localized mobile advertising — will likewise impact its growth.