Swipely: Loyalty Program Links Purchase Behavior to Promotions

One of the big bets in 2012 is that merchants will transition from one-time deals to loyalty efforts that keep bringing customers back. Swipely is one of the more ambitious efforts in a loosely defined space that also includes players such as Cartera Commerce, Edo Interactive, LevelUp, CardSpring and Kostizi.

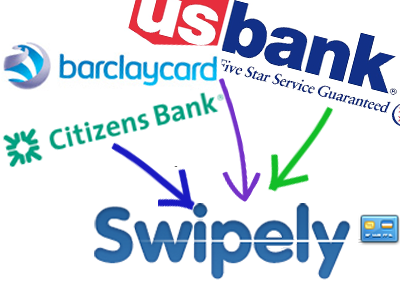

Swipely’s ambition is to provide a “turnkey loyalty program” to merchants, who pay the company based on generated sales. It is targeting “Big SMBs” with revenues between $500k to $3.5 million that accept credit cards — beyond Square.

The Providence-based company has raised $8.5 million from investors that include Index Ventures, FirstRound Capital, Greylock Partners, Lowercase Capital and angel investor Ron Conway. Launched in May 2010 in Providence, the site is now live in Boston and San Francisco, with New York and Washington, D.C., up next.

It has outside sales in those markets, and some inside sales as well. More than 350 merchants have signed up.

Consumers sign up to the service once, providing a credit card of their choice to link to merchant deals. They can sign up via word of mouth, or come in via merchants’ email lists or social media. After consumers opt into a merchant deal (typically $10 off and/or merchant loyalty points), they receive followup email promotions based on their purchasing history and purchasing frequency, and guided by day-parts, day of week and other factors.

We talked with CEO Angus Davis, a cofounder of TellMe and also a Netscape vet. Swipely has the advantage of not requiring any change in consumer behavior, he says, noting that 93 percent of people can just deploy their pre-existing credit cards. “There are no coupons, no vouchers. And merchants don’t need to upgrade in the store.”

The service has been especially built “with the goal of calculating the information behind transactions and tying the Web to payment networks,” adds Davis. “It is about more than moving money.”

And apparently, it is about more than social media, which was the site’s initial focus. “Social media is not as compelling as saving money and [receiving] rewards,” says Davis. He suggests that in the context of working with merchants, social is primarily useful to “review purchases in a seamless way.”