Flurry Reports an Imbalance in the (Mobile) Force

Mobile app analytics provider Flurry is out with its most recent data dump, showing that mobile has a disproportionate imbalance (when compared with other media) between usage and ad dollars.

Specifically there is a 23-to-1 difference in the share of time spent with mobile and its share of ad dollars. That far outweighs any other media type including TV, Web, print and radio. On the other end of the spectrum is print where a greater share dollars are spent than usage justifies.

If it’s not obvious, the opportunity — at least as far as ad support — is where the supply (usage/impressions) outstrips demand (ad dollars). That’s where a move toward equilibrium means a growth in ad dollars. And not suprisingly, that’s happening in mobile and Web.

What is suprising is the degree to which this imbalance exists in mobile. Though Madison Avenue has a knack for trailing behind usage, 23:1 is rather stark. This can be seen in optimistic terms (equilibrium point above) and pessimistic (mobile hype hasn’t panned out).

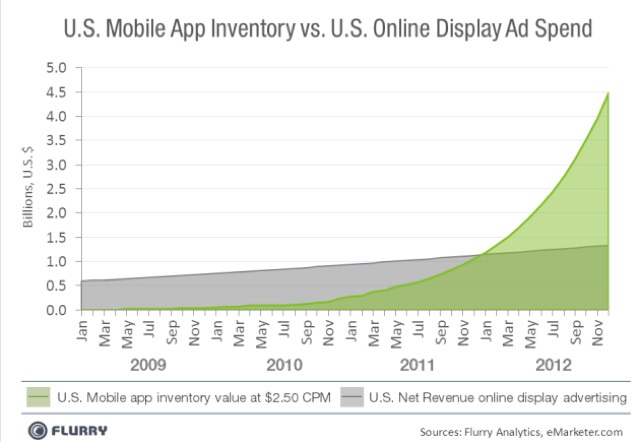

Either way, these data line up with what we’ve known to be true, and also Flurry’s very memorable recent study about mobile ad inventory. As shown below, the value of ad inventory (at a $2.50 CPM) outstrips the entirety of the online display at market.

But of course this plots available inventory of one medium against what has been sold in another (assuming 100 percent fill rate for the former), which is a bit of an apples-to-oranges comparison. Check out our past analysis on that chart, and the caution with which it should be read.

Regardless, most of the above is supportive of mobile’s opportunity. As is echoed throughout the tech media and analyst corps, but affirmed here once again, there’s massive potential market growth as demand for mobile advertising catches up with supply (usage/impressions/inventory).

One question is if this imbalance continues to exist, will mobile advertising go the way of the low-quality inventory (and tanking CPMs) of online display advertising? There’s evidence we can stave that off with premium ad inventory (i.e., location targeted) or CPA/transactional formats.

We’re not quite there yet, as we can see all around us and in data sets such as Flurry’s. Speaking of data, we’ll be out early next month with our latest bi-annual mobile ad revenue forecast. I’m deep into it now and will have more soon. Stay tuned.

I remember seeing the same types of graphs back in 2007 between Internet usage/expenditure versus traditional media.

We got in early and did really well out of the arbitrage.

Today the cost of Adwords is too high and the opportunity has gone, but it looks like mobile might be the next big arbitrage opportunity.

This is necessary for mobile advertising revenue forecasts, enter 2012, we have reason to believe it will continue to tell the growth