BIA/Kelsey Mobile Outlook: 5 Predictions and a Wild Card

Like we do every January, BIA/Kelsey analysts huddle to formulate predictions for the coming year in respective areas of domain expertise. Earlier today, we released a report that highlights picks across local media coverage areas, and Thursday we’ll do a webcast.

For more color on the predictions that pertain to mobile, below is the “director’s cut”. These are areas I’ve been watching most, and where I think they’re moving. It’s pretty clear from the momentum in these areas that it’s going to be an action packed year for mobile.

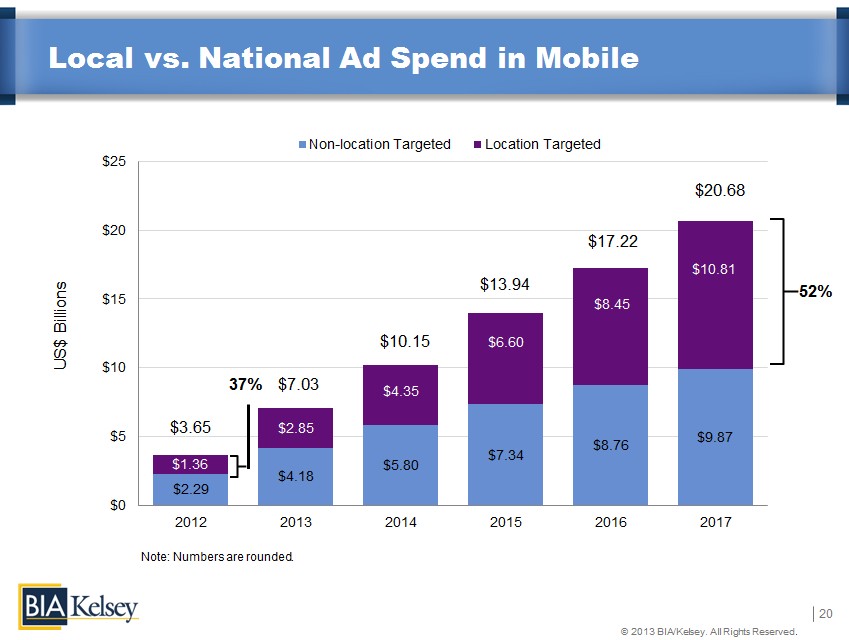

1. U.S. Mobile Ad Market Exceeds $10B

We expect the U.S. mobile ad market to exceed $10 billion this year. And the location targeted portion of that ad spend will approach 40 percent. This includes all mobile ad formats including developing areas like social native ads (i.e. FB mobile news feed ads).

Our figures also take into account the growth of search ads (currently the largest share of mobile ad revenue) and what Google’s Enhanced Campaigns will do. This was one key growth driver in our forecast, as Enhanced Campaigns will accelerate mobile advertiser adoption.

The more populated search bid marketplaces that result will also raise bid pressure and increase cost per click rates for certain keywords and in certain locales. Higher CPCs will in turn boost mobile ad revenue further for Google and mobile publishers/developers alike.

What to watch for: The longstanding lag in mobile ad rates will begin to reverse as sources of premium ad rates continue to be found. That includes native social ads on places like Instagram, attribution, and higher performing location targeted ads from companies like xAd.

2. The Discovery Channel

Big data will continue to collide with mobile, inspiring app layer innovation in the form of personalized local discovery tools like Google Now. These will tap growing sources such as email, weather, location and behavior, to become better predictive engines for content delivery.

This discovery paradigm will also compel different user interfaces than the SERP based format that ruled the desktop. Push alerts will engage users outside of apps and swipeable card-based interfaces will replace traditional SERPs within many apps. We’re already seeing this.

Push alerts are executed well by Find & Save, and card based interfaces can be seen in local discovery (weotta, Google Now), social (Tinder), and multimedia (Swell). These more intuitive engagement points boost user inputs (sentiment) by which to base ongoing discovery.

What to watch for: This data-driven content delivery “push” won’t just apply to apps but also ads. Data will be a key driver in more effective ad delivery and thus squeezing more value out of mobile advertising, per the numbers in the above prediction.

3. How Much is That Dongle in the Window?

Real time product and transaction data will be a key battleground in the continued evolution of mobile local shopping. This will come into play at the app layer (shopping apps, product finders) as well as location targeted ads that specify product availability.

The key here will be data. Retailigence has done some impactful stuff with data sets that take form in an API for app developers and advertisers to add product inventory to mobile shopping experiences. This will become vital over time.

What to watch for: The next inflection point will be in indoor location and shopper engagement apps and technologies built around iBeacon. “Demand pricing” will be the wild card when big data can segment audiences for yield optimization via personalized offers.

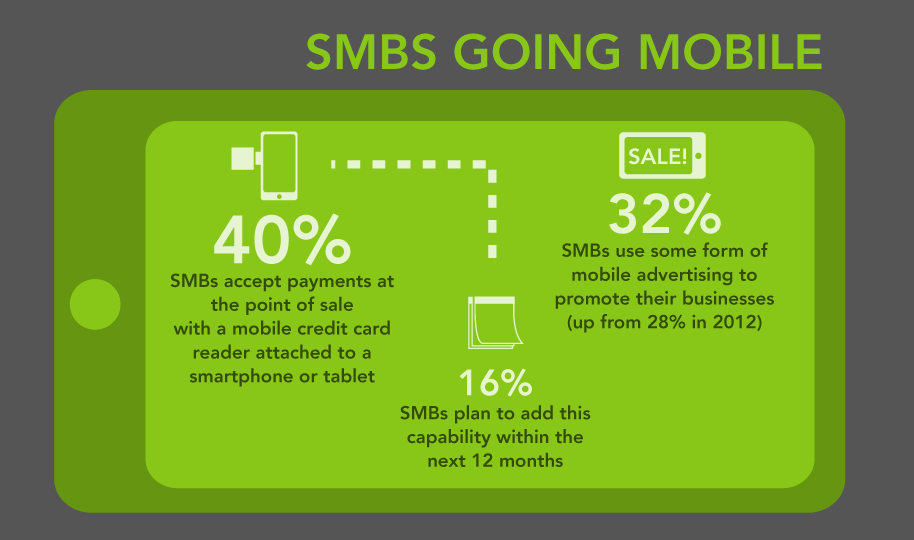

4. SMB-Facing Mobile:

The local media sector will slow down it’s enamored view of consumer-based mobile apps as the shiny new thing; and take a more measured approach to mobile adoption and product development. This will involve turning attention to business-facing apps

Tools that help SMBs acquire new business and run their business on the go will be the name of the game. This will include operations like appointment scheduling and payment processing; and other back office tools accessed and managed in a mobile interface.

What to watch for: Merchant-facing mobile tools will shine and grow most within local business categories like restaurants and home services, where proprietors are in constant motion. This will be a key component of the “OS for SMBs” trend we’re covering.

5. Mobile Value Lies in MAUs (for now):

Seemingly illogical valuations will continue for mobile apps without revenue (Snapchat anyone?). This will be based mostly on the premium for user acquisition and engagement — due in turn to escalating competition in app marketplaces to sustain active usage.

The most successful and highly valued apps will continue to be those that inherently lock in users for active and recurring engagement (i.e. Tinder, Instagram, Snapchat). Foreseeable revenue models be damned; scalable and recurring active usage is the name of the game.

What to watch for: These success factors will continue to rule the mobile app marketplace in the near term, but could begin to deflate later in the year as app fatigue compels a shakeout and consolidation (read: Facebook) of apps oriented towards social sharing.

Wild Card: The Internet of Things Goes Local

The Post-PC era will continue to broaden beyond smartphones to include wearables, biometrics, in-auto and all the sensor driven technology that surrounds us in the Internet of Things. This will change development paradigms around what we consider “mobile”.

Local implications abound, considering the personalized commercial needs that the internet of things uncovers. Think home services (the connected home), auto (in-car diagnostics), and local search (Google Glass). Local will be a big benefactor of the Internet of Things.

What to watch for: The biggest challenge will be developing apps with consistent brand experiences across myriad form factors, yet optimize native experiences for each one. Best practices in multi-screen product design so far can be seen from Netflix, Spotify and HBOGo.