Square’s Mobile Transactions Gives Company $5B Valuation

Square’s million share tender offer values the company at a whopping $5 billion and illustrates just how hot the mobile payments space has become. BIA/Kelsey’s survey data certainly captures this momentum, showing that both consumers and small-businesses are embracing mobile payments.

Square began offering credit-card readers in 2009, which allow merchants to accept payments on mobile devices. Square originally targeted small businesses, but it now also sells a point-of-sale terminal for use in retail stores and has tools to help merchants sell online. The company charges a fee of 2.75 percent per transaction, along with free software.

Square competes with companies like EBay Inc.’s PayPal, Inuit, iTransact, and Shopkeep POS in the payments software space. In BIA/Kelsey’s Local Commerce Monitor™ (LCM) survey on advertising and marketing of small and medium businesses (SMBs), we asked SMBs about their usage of a mobile credit card swipe. 40% of respondents currently use one and an additional 16% said they are likely to adopt one for use within the next 12 months.

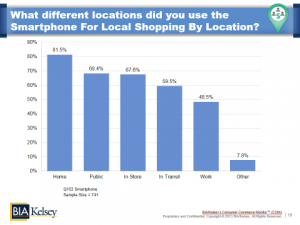

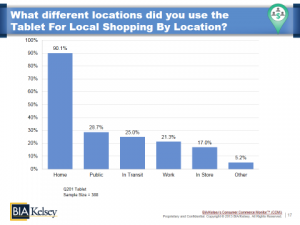

According to our Consumer Commerce Monitor (CCM) survey, consumers report using mobile phones and tablets to shop locally. We asked consumers how they find, engage and transact with local-serving businesses, including where they use their mobile devices. Consumers using smartphones report being far more likely to use their devices for local shopping while out of their homes, while consumers using tablets are far more likely to use their devices at home.

(Local Shopping means 25 mi radius from respondent’s primary residence)

When it comes to mobile payments via credit swipe, 42% of consumers say they have done so. The heaviest users are the 35-44 age group (45.4%) and Hispanics (48.9%).

35-44 yr olds local shopping characteristics:

- 64% perform their local shopping in store

- 28% perform their local shopping online

- 68% hold an associate’s degree or higher

- 50% household income ranges from $50,000 to $124,999

Hispanic local shopping characteristics:

- 57% perform their local shopping in store

- 31% perform their local shopping online

- 58% have an associate’s degree or higher

- 41% household income ranges from $50,000 to $ 124,999.

SMBs realize that more of their customers are going mobile and they are optimizing their presence to be more mobile as well. According to our LCM survey, almost 40% of SMBs reported that mobile marketing is a high priority in the next 12 months.

Check out BIA/Kelsey’s LCM page for more information.